Is dropshipping legal in India? You must know the rules and taxes to start selling products online in India.

We looked at the new rules and orders for dropshipping businesses in India. This guide will show you what you need to know to do it right.

Let’s go through each one together!

Table of Contents

Is Dropshipping Legal in India?

Yes, dropshipping is legal in India, but make sure to follow some rules:

- Follow local, national, and international regulations: A dropshipping business must follow all the rules for selling products, regardless of where it operates.

- Avoid selling prohibited products: Make sure the products you sell are safe and allowed in India. Don’t sell dangerous objects or certain chemicals.

- Ensure tax compliance: Register for a GST number to pay a little money for what you sell.

- Maintain transparency with customers: Tell people how long it takes to get their stuff and if they can give it back.

- Partner with reliable suppliers: Assess the quality of service and approachability of suppliers.

- Consider drafting legal agreements: If something goes wrong, ask a lawyer to check any deals with other companies to see who will fix the issues.

Do I Need GST for Dropshipping in India?

Let’s understand through example.

Sonal has a dropshipping business where he sells goods to people without keeping them in stock. When someone, like Suresh, wants to buy something from him, Sonal asks his friend Prateek to get the item and send it to Suresh. Suresh pays Sonal, and Sonal sends him an invoice. Prateek just sends the item to Suresh for Sonal; he doesn’t add his own name to the invoice.

Prateek will give an invoice to Sonal because he sold products to Sonal, not to Suresh. Sonal is eligible to claim the input tax credit for the following invoice.

GST Registration: According to Taxadda, if Prateek and Sonal make more than 40, 20, or 10 lakhs, they need to register for GST. They also need to register if they sell goods in a different state or place.

GST on Dropshipping:

Here’s a simple overview of how GST applies to different types of transactions.

1. Goods Sold Abroad but Purchased in India

When products are sent to a different country, the person doing dropshipping (selling without holding stock) must add GST (a type of tax) as usual. For the merchant, this is called an export sale, so they have two choices: they can either skip GST if they fill out a special form (called LUT), or they can pay GST first and ask for the money back later.

When the dropshipper sends an invoice to the merchant, he gets a special discount on tax. Instead of paying the full tax, he only needs to pay a very small amount: 0.05% for two kinds of tax or 0.1% for another kind, depending on the rules. But, he has to follow some extra rules to use this discount.

GST Registration: If a dropshipping business makes a lot of money (more than Rs. 40, 20, or 10 lakhs, depending on the type of business), it needs to register for GST, which is like a special money rule. Also, if there’s a rule that says the business has to pay GST in a special way (called “reverse charge“), then it needs to register too.

2. Goods Purchased Abroad and Sold in India

If a dropshipper from outside India sends goods to a merchant in India, the shop owner has to pay a special tax called IGST when the goods arrive in India. Later, the merchant can use this IGST amount to reduce other taxes they owe. When the merchant sells these goods, they will add the usual tax to the price for the buyer.

GST Registration: You need to get GST registration, even if you don’t make a lot of money.

3. Goods Purchased and Sold Abroad Without Entering India

This situation is like when you’re playing with toys, and your friend, who is outside, gives a toy to another friend who is also outside. The toy never comes into your house, so it’s not like you’re giving or receiving the toy. In GST rules, this kind of exchange from one place outside India to another place outside India is not counted as buying or selling in India. So, there’s no tax (GST) on it.

Section 2(10) of the IGST Act says that “import of goods” means bringing goods into India from another country.

In this case, because the goods aren’t actually entering India, it doesn’t count as an import. So, GST doesn’t need to be paid through reverse charge.

GST Registration: You don’t need to register for GST, even if you make more money than the usual limit.

4. Reverse Charge

Reverse charge GST means the person who gets a service has to pay GST, not the person who gives the service. If you buy services from outside India, reverse charge GST applies.

If you need to pay GST through reverse charge, you must register for GST, even if you make less money than the usual amount needed for GST registration.

A person who sells goods online might need help from people outside India. They use delivery services to send packages. Sometimes, they also ask other people to check the items to make sure they are of good quality.

Now, we need to ask: Do these services count as services coming into our country?

According to Section 2(11) of IGST, a service is called an import if:

- The person giving the service is not in India.

- The person getting the service is in India.

- The service happens in India.

So, if all three of these conditions are true, then it’s called an import of services.

If someone helps check or look at some goods, Section 13(5) of IGST rules says we look at where that help happens to decide where it’s from. So, if a person checks the goods somewhere, that’s where it counts.

Since all the rules don’t match, we don’t treat it like bringing services from another place. This means we don’t have to pay extra tax for that help.

When we move goods from one place to another, we think about where they are going. If goods go outside of India, we don’t have to pay a special tax for bringing them in.

But, for some special services, you might need to register to pay a different kind of tax.

Do You Need a GST Number for Dropshipping in India?

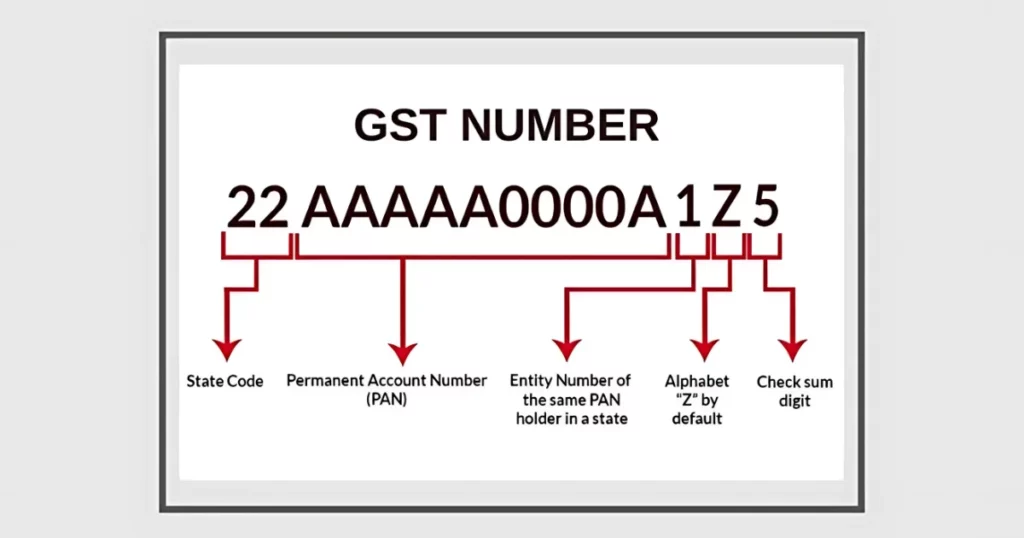

If you want to sell goods in India, you need a GST number. This number shows that you’re allowed to sell goods.

You get it by registering on a website. After you have this number, you have to tell the government what you sold and pay a bit of money for each sale.

What are the Legal Requirements in India for Dropshipping?

According to Camantra, where you run your online store can change what rules you need to follow. In some places, there are no rules, while in others, there are many rules to think about.

Some countries help online stores grow, but others have strict rules that can make it harder. Remember, the rules depend on where you are.

1. GST Number

When goods are sold outside of India, the dropshipper needs to charge GST from the seller, just like usual. The seller can either get a LUT to sell without charging GST or pay IGST when selling and later ask for a refund.

When the dropshipper sends an invoice to the seller, they can follow a special rule (Notification no. 40/2017) and pay a very small GST of 0.05% for both CGST and SGST or 0.1% for IGST. But there are some rules they need to follow to get this benefit.

2. Current Account

To start a dropshipping business, you need to open a current account.

3. IEC

Exporters of goods and services from India must have an IEC.

What are the GST Registration Documents for Dropshipping?

| What You Need | What It Is |

| PAN Card | A card that shows your business’s tax number. |

| ID and Address Proof | Papers showing who the bosses are, with pictures (like Aadhaar, passport, or driver’s license). |

| Business Registration | A paper that says your business is official. |

| Business Address Proof | A paper that shows where the business is. |

| Bank Proof | A paper from the bank that shows your money (like a bank statement or a cheque). |

| Digital Signature | A special way to sign your papers online (for companies). |

| Authorization Letter | A letter that says who can sign papers for the company. |

How To Do GST Registration For Dropshipping?

Here’s how to register for GST, step by step:

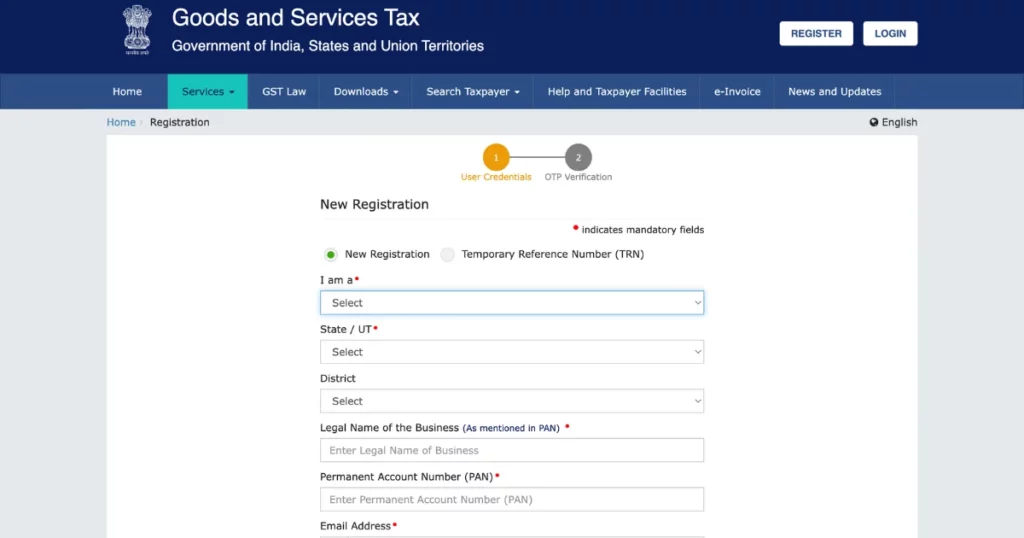

1. Go to the GST Website

Open the GST website and tap “Register Now”.

2. Click on Services

Find the “Services” button, then click on “Registration,” and pick “New Registration.”

3. Fill Out Part A

Choose “New Registration.” Fill in your information and click “Proceed.”

4. Get a Code

Check your email and phone for a code to verify who you are.

5. Get a Number

After you verify, you will get a TRN. Remember this number.

6. Fill Out Part B

Go back to the GST website, click on “Services,” then “Registration,” and “New Registration.” Enter your TRN, solve the puzzle, and click “Proceed.”

7. Verify Again

Enter the code you get in your email and phone again.

8. Fill the Form

Complete the GST registration form with your details.

9. Upload Papers

Upload your important papers like your ID and business proof.

10. Check Your Application

Use your digital signature or code to check your application.

11. Get Your ARN

After checking, you will receive an ARN to track your application.

12. Wait for Approval

The GST officer will look at your application. If everything is okay, you will get your GSTIN.

13. Receive Your Certificate

Once approved, you will get your GST certificate with your special GSTIN.

Do Dropshippers Have to Pay Taxes in India?

Yes, people who sell goods in India have to pay taxes. This includes income tax, GST, and other taxes according to Indian rules.

Types of Taxes:

- GST (Goods and Services Tax):

- Applicable to all businesses.

- Threshold limit: Rs. 20 Lakhs.

- Tax rate: 0% – 28%.

- Income Tax:

- Applicable to individuals.

- Threshold limit: Rs. 2.5 Lakhs.

- Tax rate: 0% – 30%.

- Corporate Tax:

- Applicable to companies.

- Based on income: 25%.

Dropshipping businesses must follow these tax rules to avoid any problems later on.

What are the GST Rates on Dropshipping Business?

The GST rate for dropshipping in India changes based on the type of product. Here’s a simple way to see the rates:

- 0% tax on basic goods we need every day, like food and medicine.

- 5% tax on items like clothes and shoes.

- 12% tax on some household items, like electrical products.

- 18% tax on goods like soap and oils.

- 28% tax on fancy items like cars.

Each group has its own tax rate, set by India’s government.

If someone is selling a product for ₹1,000, the tax (GST) they need to add is ₹180 because the tax rate is 18%. This tax is based on the price they sell the product for, not what they paid to get it.

There’s a rule for dropshippers who don’t make more than ₹40 lakhs in a year. They don’t have to register for GST unless:

- They sell their products through online shopping websites.

- They send products to other states.

This is a way to keep it simple for small sellers.

Can You Run Two Businesses in India Under One GST Number?

You can use one GST number for different businesses if they are in the same state and share the same main ID (PAN number).

However, each business still has to register by itself and do its own tax paperwork. Each one also needs to keep its own records for buying and selling goods to follow GST rules.

Example:

Case 1:

- Samar, who lives in Hyderabad, buys a T-shirt from you for Rs.500.

- You buy the same T-shirt from another company (Blinkstore) for Rs.350.

- You show both the sale (Rs.500) and the purchase (Rs.350) when you pay your taxes and pay Rs.7.5 as tax.

Case 2:

- Rajat, from Mumbai, buys a T-shirt from you for Rs.600.

- You buy the same T-shirt from Blinkstore for Rs.300.

- You show both the sale (Rs.600) and the purchase (Rs.300) when you pay your taxes and pay Rs.15 as tax.

In each case, you add up both the sale and purchase amounts to calculate the right tax.

How to File GST Returns as a Dropshipper?

To do GST returns, you need records of what you sold, what you bought, the taxes on those sales, and the taxes you paid on those purchases. You file two returns each month and one each year.

First, you enter the sales details by the 11th of each month (this is called GSTR-1). After that, another return (GSTR-3B) gets the numbers from GSTR-1 and your suppliers, and you need to submit it by the 20th of the month.

When you sell something, you make a sales note for your customer. You file all these sales notes as GSTR-1 by the 11th of next month.

Then, by the 20th, you file GSTR-3B to show all sales and tax credits from purchases. If you sell on online marketplaces, you can also match up tax credits from TCS here.

Get Started with Blinkstore (free) for Dropshipping in India

Blinkstore helps you start a small print-on-demand business in India without paying upfront. You can sell t-shirts and other accessories online, even though you don’t have them at home with Blinkstore dropshipping and fullfilment business.

How to Start a Shop with Blinkstore in India:

Step 1: Make an Account

Go to Blinkstore.in and make your account.

Step 2: Pick a Name for Your Shop

Choose a name, and Blinkstore will give you a website link for your shop.

Step 3: Choose Products to Sell

Look at Blinkstore’s products and pick the ones you want to sell, like clothes or home items.

Step 4: Make Your Shop Look Nice

Use Blinkstore’s tools to make your shop look special. You can add a logo, pick colors, and show off products.

Step 5: Set Up Payments

Make it easy for people to pay by adding safe payment options.

Step 6: Open Your Shop

Check that everything works, then tell people about your shop online to get your first customers.

Step 7: Handle Orders

Blinkstore helps with sending out orders. You just keep an eye on them and update your customers!

Blinkstore is the best print-on-demand site in India due to free upfront costs, a user-friendly platform, an extensive product range, and efficient fulfillment and shipping.

Conclusion

In conclusion, you have discovered the answer to the question: “Is dropshipping legal in India?”

Who wouldn’t want to make money without working hard? Everyone would like that, right? With dropshipping in India, you can earn money by selling things online. The best part is you don’t have to make, pack, or deliver anything yourself.

Running a dropshipping business in India means you need to keep proper records. One important task is making professional invoices to follow GST and tax rules. Using an Invoice Receipt Template in PDF can make this easier.

It helps you create neat and accurate receipts for your sales, making your business look trustworthy.

So, don’t wait! Start dropshipping in India today. There are lots of products and many people who want to buy them, so you’ll do great! If you’re unsure, just read the article again.

FAQs

Is dropshipping legal in India without investment?

Yes, dropshipping is legal in India and can be started with relatively low investment. To operate legally, avoid selling restricted items such as drugs, chemicals, or dangerous products, and adhere to consumer protection laws. Make sure to pay both income and sales taxes on your earnings. Maintaining transparency with customers is crucial; provide accurate information about shipping times and return policies. It’s also important to carefully select reliable suppliers to ensure product quality and timely delivery.

How to start dropshipping with 0 RS?

To start a dropshipping business with minimal funds, research trending products using free tools like Google Trends. Choose a niche you’re passionate about and locate reliable suppliers through platforms. Set up your store in Blinkstore and promote the store yourself to save on marketing. Ensure quick order fulfillment, and excellent customer support, and register your business in India with the Ministry of Corporate Affairs or MSME, including GST registration.

Who is the most successful dropshipper in India?

While information on India’s most successful dropshippers is limited, Blinkstore stands out as one of the leading dropshipping companies in India.

Does dropshipping require a business license in India?

No, you don’t need a special license for dropshipping in India, but you’ll need to register your business as a sole proprietorship, partnership, LLP, or private limited company. A GST number may be required for online payments, and you’ll also need to open a business bank account. An Import/Export Code (IEC) could be necessary, and if your sales are high, you might need to pay extra taxes.

Is dropshipping safe in India?

Yes, dropshipping is safe in India. It’s a good way for people to start a business. By picking the right products and selling good items, you can make a popular online store and join India’s big online shopping world.

Is dropshipping legal in India for beginners?

Dropshipping is legal in India for beginners, and it’s easy for new people to start. You don’t need papers to begin, but if you want to sell on big websites or sell a lot, you need to get a GST registration.

Related reading: