Are you interested in learning more about Gold GST Rate in India for 2023? Procure the most recent information on the GST rates that are applicable for buying and selling gold in India, including the current rate, any future adjustments, and knowledgeable opinions on how the GST affects gold prices. Our thorough guide on Gold GST rates in India will help you stay informed and make wise decisions.

Table Of Contents

Introduction

India has a long history of gold ownership, with generations using the precious metal as a gift and investment option. Sources say that Indian women possess the world’s 11% of total gold. For those wishing to invest in or trade gold, as we go into 2023, the Gold GST Rate in India is still a matter of interest. This article discusses the present gold GST rate in India, any foreseeable adjustments, and any prospective effects on the gold market. In order to help you navigate this dynamic and constantly shifting market, we’ll also offer professional views and analyses. Thus, continue reading whether you’re a seasoned investor or a first-time purchaser.

Gold GST Rate in India

A new era in Indian taxation begin on July 1st, 2017, with the implementation of the Goods and Services Tax (GST). According to reports, gold imports hit a two-year high in March 2021. Gold was subject to a fixed 3% GST, plus an additional 8% tax on charges. In response to objections voiced by various parties, the tax on the making charge was subsequently decreased to 5%. You won’t have to pay tax, though, if you sell your old gold jewellery and buy new jewellery at the same time. By exchanging their old gold, people can avoid paying the goods and services tax registration fee when buying new gold.

Also Read: How To Start A Clothing Business Online In India? (10 Benefits)

Gold GST Rate in India before and after GST Implementation

Before the Goods and Services Tax (GST) was implemented in India, the gold rate was subject to a number of taxes, including excise duty, VAT (Value Added Tax), and customs duty, all of which were imposed independently by the central and state governments. As a result, the tax system became complicated, making it challenging to determine the final price of gold.

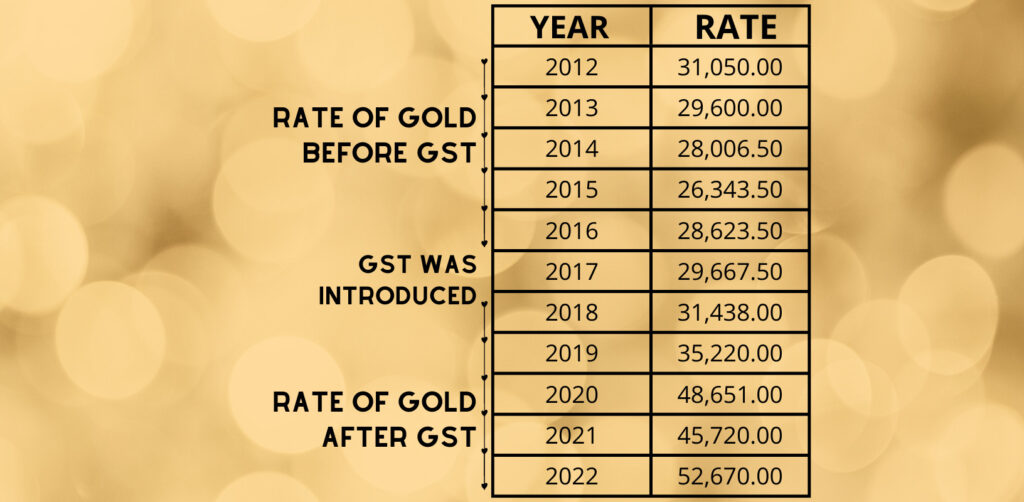

All of these levies were replaced by a single tax after the introduction of GST in July 2017, simplifying the tax system and making it simpler to determine the ultimate price of gold. Consumers and traders initially had some questions about the new tax system and how it would affect the price of gold. Yet, over time, the removal of several taxes brought about by the introduction of the GST has resulted in a decrease in the price of gold. Refer to the below chart for more clarification on this.

GST on Gold Jewellery in India

The Gold GST rate in India is about 3%, and charges for manufacturing gold cost you 5%. Moreover, let us be clear that this 5% rate is applied to making fees, which vary from jeweller to jeweller. The amount you receive at the end varies significantly as a result of this making charge. Let’s take an example for better understanding. Let’s say you purchase a gold ring for INR 55,250 and the price includes both the gold and making charges. So if we break the price down it would be something like this:

Gold Value: Rs. 50,000/-

Making Charges(10% of Gold Value) = Rs. 5000/-

GST on Making Charges (5% on Making Charges) = Rs 250/-

Total = Rs. 55,250/-

GST on Digital Gold

Investing in gold jewellery might not be the best option if you are considering it as an asset but in India, it is mostly about emotion. So the main question is “the gold worth the high cost? Well if we can use it for gifting purposes it can be an excellent choice. Digital gold can be a great alternative in this case. In digital gold, you can avoid these making charges and they are also safe in comparison to physical gold. However, 3% GST is also applicable here.

Gold GST in Different Sectors

Gold GST rate in India had a significant influence on the Organisational and non-organisational sectors. Here are a few points to highlight:

1. Improved Transparency

The GST’s adoption has improved the gold industry’s transparency. Now that all transactions must be registered with the GST portal, it is harder to evade taxes.

2. Reduced Chances of Tax Evasion

As all transactions are recorded, the likelihood of tax avoidance has decreased. Input tax credits are available to enterprises, and GST is collected on gold at every point in the supply chain. Businesses are now encouraged to accurately report all transactions.

3. Increased Compliance Costs

Since the introduction of the GST, businesses have been subject to a variety of rules. They must comply with the requirements of GST audits, file monthly or quarterly GST returns, and keep proper records. Businesses now pay more to comply as a result.

Gold GST Exemption

At the 31st GST Council meeting, it was announced that gold supply to authorised jewellery exporters was excluded from GST. By easing the burden of the GST on exporters of gold jewellery, this exemption intends to boost India’s gold export industry’s ability to compete in the international market. On the other hand, authorised jewellers are eligible for a 2% input tax credit on the costs associated with producing jewellery. As a result, exporters of gold jewellery will profit from the exemption rather than domestic consumers. Despite hopes that the imposition of the tax would promote greater openness and accountability in this industry, suppliers are now turning to unorganised gold markets and illegally importing raw gold.

Gold as an Investment Option

Since ancient times, gold has been a well-liked investment choice, and it still draws money from investors today. While determining whether gold is an appropriate investment for you, keep the following things in mind:

Protection Against Inflation: Protecting against inflation is one of the key reasons investors resort to gold. The cost of gold typically increases as the value of fiat money declines. As a result, gold can support the preservation of your wealth and purchasing power during periods of inflation.

Diversification: Gold can be a fantastic instrument for your investment portfolio’s diversification. It typically has little correlation with other asset classes like equities and bonds, which can help lower the risk of your entire portfolio.

Safe-Haven Asset: Gold is frequently seen as a safe-haven asset. Investors frequently turn to gold as a store of value during periods of economic and political unpredictability. Also, gold can assist in securing your assets during periods of market turbulence.

Liquidity: Gold is a very liquid investment. It is an accessible investment choice for investors of all sizes because it is simple to buy and sell on international marketplaces.

Storage and Maintenance: Gold does have storage and maintenance requirements, despite the fact that it is a generally stable investment. Fees for storage and insurance must be paid if you decide to invest in actual gold. You must pay management fees if you invest in gold mutual funds or exchange-traded funds (ETFs).

In Easy words, if you want long-term stability and diversification you can invest in gold.

Conclusion

In conclusion, the Gold GST Rate in India is still low when compared to other luxury items. Due to this, gold is a desirable investment choice for many Indian investors. Investors benefit from some certainty due to the existing GST rate’s stability, despite the fact that it may vary depending on the GST Council’s decisions.

The popularity of gold as an investment choice in India is mostly a result of the country’s 3% GST rate on gold, which is advantageous for investors. Hope that this article was helpful for you to understand the concept of Gold GST rate in India.

FAQs

-

What is the Gold GST Rate in India in 2023?

In India, there is a 3% Tax on gold. Moreover, jewellers add a GST manufacturing charge of 5% to the pricing.

-

Can gold be claimed for GST?

If you are a registered jeweller, you are eligible to receive a 2% input tax credit on jewellery manufacturing costs.

-

Is it possible to avoid paying GST on gold?

No GST will be assessed if you sell your old gold jewellery and buy new gold jewellery at the same time. This means that people can reduce their GST tax by simply swapping their old gold for new gold.

-

How much gold in India is exempt from taxes for women?

In India, a married woman is permitted to own up to 500 grammes of gold, but an unmarried woman is only permitted to own 250 grammes.